OUR OBJECTIVE

Learn To Trade In a Simple Way

Learn the basics of the stock market, to enhance the understanding of how does the Stock market works and what makes you earn in the market.

Join India's Most Advanced Trading Course

Welcome to King Research Academy

Our Mentor and Trainer Mr. Harinder Sahu is a an experienced Stock Trader, with more than 19 years of trading experience and has trained more than 100,000 students to become a self trader

India's Biggest Stock Market Event

Market Manthan 2024

We Are Featured On Your Favroite Platform

Media Coverages

Become A Profitable Trader From A Loss Making Trader

For Any query

Join The Most Simplified Trading Course

1 Lakh+ Happy Students

We have educated more than 1 Lakh Students

19 Years of Experience

Our founder Mr. Harinder Sahu has been trading from last 19 years.

6.5 Lakh+ Youtube Followers

More than 6 Lakh active traders learn & follow us on youtube

Telegram Community

14+ Premium Strategies

Lets Get Started

India's Most Advanced Trading Course

6 Month After Training Support.

Revision Classes

Premium Trading Setup

Trading System Development

Access To Mentorship Program

Access To Lifetime Free Calls

Boost Your Trading & Investing Knowledge

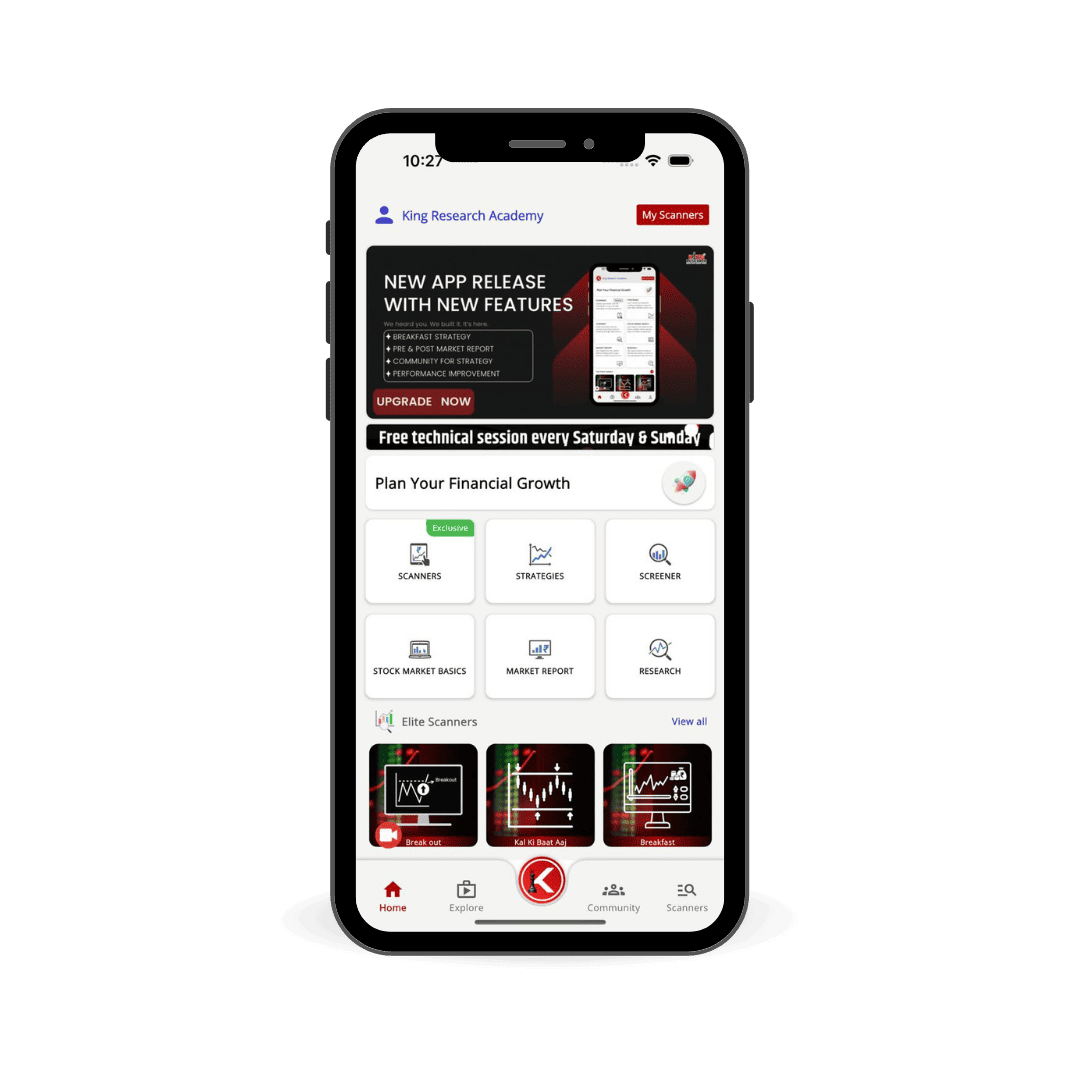

Now get access of premium video courses on mobile app – You can gain access of our premium courses and trading strategies

Learn 24/7

Learn at your own pace through our easy to navigate Android app.

Learn From Scratch

Learn the basics to advance of the stock market.

Video Lectures

Learn through high-quality & easy to understand video lectures.

Revision Classes

Access of Revision classes to help you cover any topic you miss

To find out more about our Online Courses

OUR OBJECTIVE

We Train !! You Gain !!

Happy Students

Training Sessions Done

Frequntly Asked Questions

If you have any queries related to our services,check FAQ section

How long will the training go on for ?

6 Months. You will have 16 theory classes for Weekday Batch and 8 theory classes for Weekend Batch. (It will be done in a period of 4-5 weeks). Both batches will have same number of training hours. After you complete your theory classes, you will have doubt clearing sessions and also other special sessions regularly.

How can I contact the company once I have paid the fees ?

Kindly send a screenshot of your payment confirmation & your email address & phone number used while making payment. A client manager will be assigned to help you in every aspect of you journey with us. You can also always call us on “84688-11500” & mail us at “support@kingresearch.co.in”

Check Out Some students Reviews And Their Experience

"The lectures delivered by Mr. Harinder Sahu were simply amazing. Even as a fresher never felt like I was missing out on something. I got to learn a lot about the market’s ups and downs, what technical analysis is all about."

Devansh

Trader

"It has benefited me lot as I joined this course to know about the market and here I came to know many things about the stock market theoretically as well as practically implement it in trading and also gained knowledge"

Priyanka

Trader