India's Most Reliable Intraday Strategy

Trusted and used by 55,000+ Intraday traders in India

NO BRAIN STRATEGY is King Research Academy Most trusted and heavily demanded intraday strategy. People already using it and making a profit every day with minimal capital investment.

NO technical knowledge required.

Anyone can make profit

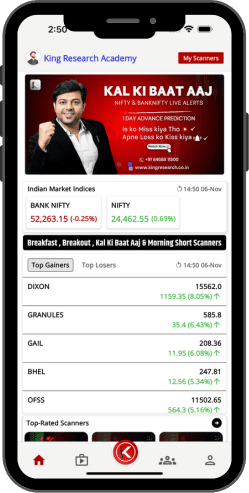

Find the most active stock

Stop-loss hunting

FREE Scanner

Access of Premium Telegram Channel